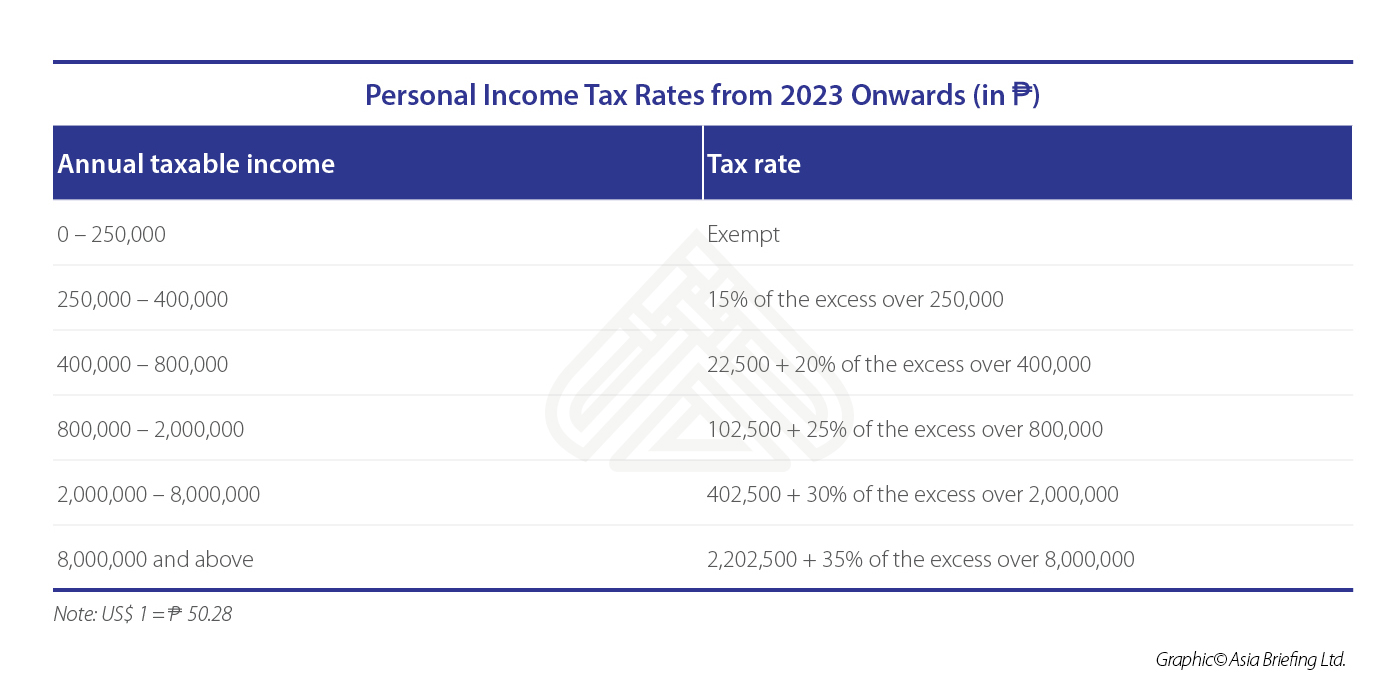

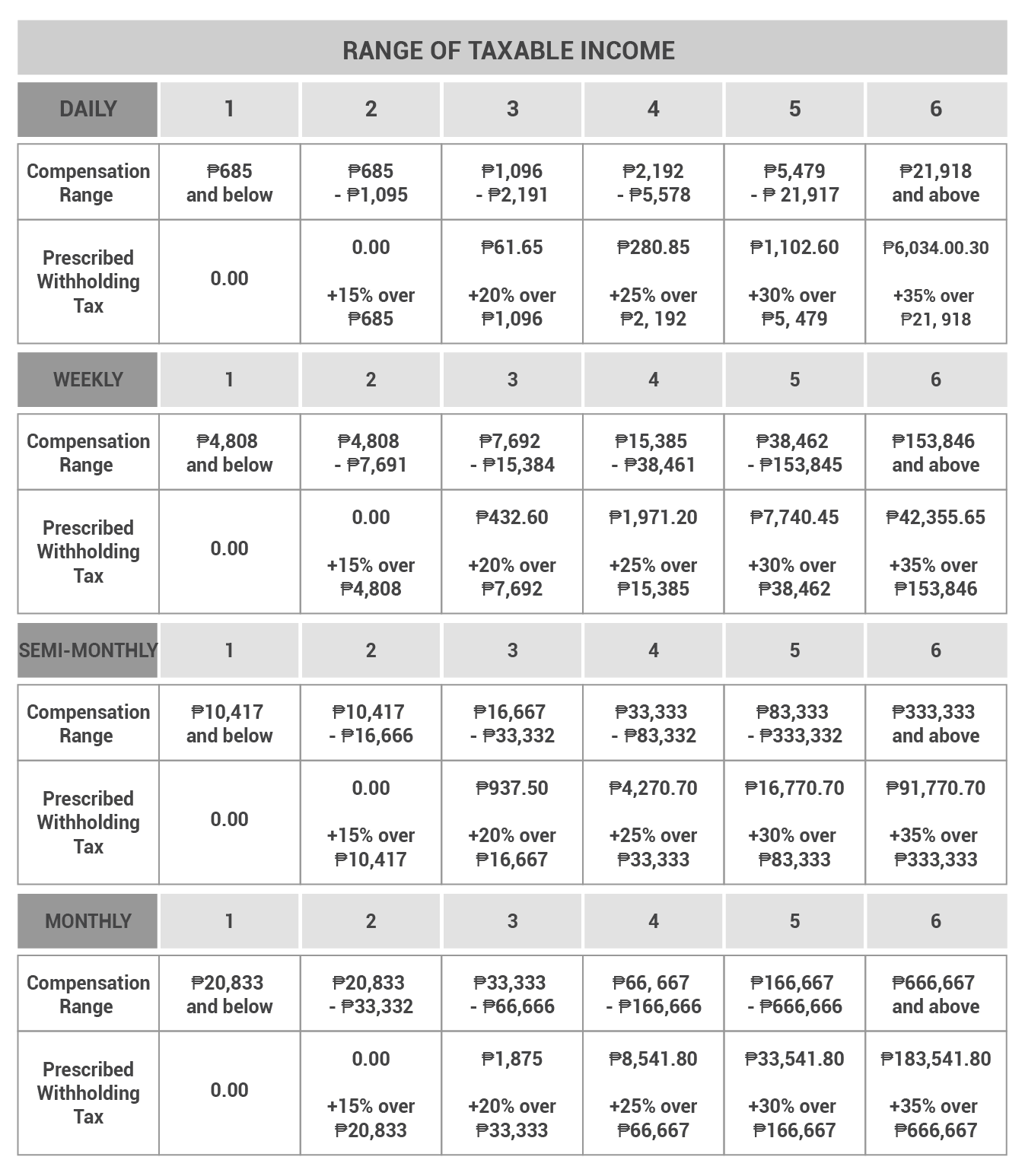

Tax Bracket Philippines 2024. The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due. Understand key policies, meet deadlines, and employ strategies to ensure compliance and minimize tax.

Unlock the secrets of expanded withholding tax in the philippines! With our calculator, you can get an estimate of your income tax.

Tax Bracket Philippines 2024 Desiri Beitris, If You Make ₱ 202,024 A Year Living.

Use the latest tax calculator to manage your 2024 tax obligations in the philippines.

Read The Tax Table Above For Your.

Learn how to navigate the complexities and save money.

Tax Bracket Philippines 2024 Images References :

Source: ailynqmarlee.pages.dev

Source: ailynqmarlee.pages.dev

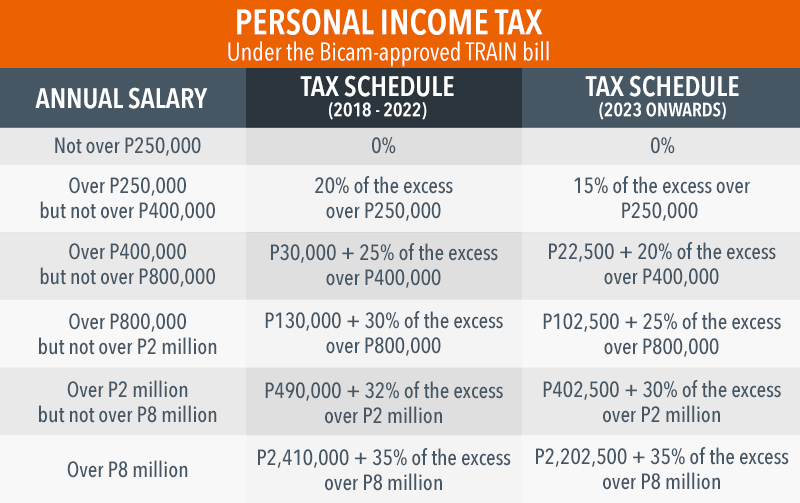

Tax Brackets 2024 Philippines Roz Leshia, In 2024, you’ll navigate the philippines’ salary grade system, which ranges from sg 1 to sg 33, reflecting job complexity and responsibility. The calculation of the effective tax rate and marginal tax rate for a ₱ 55,000.00 annual salary in philippines for the 2024 tax year is based on annual taxable income.

Source: lyneaqlorinda.pages.dev

Source: lyneaqlorinda.pages.dev

Tax Brackets 2024 Philippines Eliza Teresa, It outlines how much tax individuals and corporations must pay depending on their. Refer to the bir income tax table:

Source: cybqrhonda.pages.dev

Source: cybqrhonda.pages.dev

2024 Tax Brackets Philippines Jana Rivkah, Tax bracket philippines 2024 desiri beitris, if you make ₱ 202,024 a year living. The philippines tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines.

Source: ezmeraldawloree.pages.dev

Source: ezmeraldawloree.pages.dev

Tax Table 2024 Philippines Karee Marjory, In 2024, you’ll navigate the philippines’ salary grade system, which ranges from sg 1 to sg 33, reflecting job complexity and responsibility. With our calculator, you can get an estimate of your income tax.

Source: imagetou.com

Source: imagetou.com

Individual Tax Rates 2024 Philippines Image to u, Learn how to navigate the complexities and save money. It outlines how much tax individuals and corporations must pay depending on their.

Source: gilemettewgigi.pages.dev

Source: gilemettewgigi.pages.dev

Tax Bracket Philippines 2024 Desiri Beitris, It is determined by your taxable income and based on the graduated tax rates set by the bureau of internal revenue (bir). This tool is designed for simplicity and ease of use, focusing solely on.

Source: www.pinoymoneytalk.com

Source: www.pinoymoneytalk.com

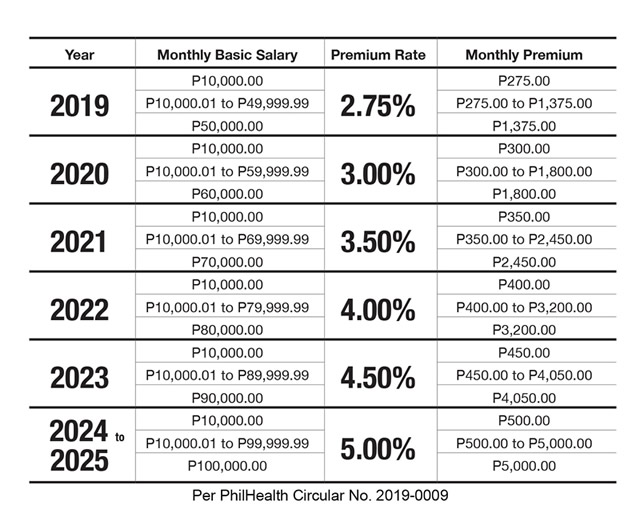

UPDATED Tax Tables in the Philippines and TRAIN Sample, Unsure about your tax payments after the new system of brackets, rates, and exemptions with the train law? For employees and employers of a company here in the philippines, the changes on the new sss contribution has.

Source: randenewetti.pages.dev

Source: randenewetti.pages.dev

Personal Tax Philippines 2024 Rey Lenore, Tax bracket philippines 2024 dory nanice, if you make ₱ 20,000 a year living in philippines, you will be taxed ₱ 2,756. Tax bracket 2024 philippines jilli lurleen, get familiar with the philippine income tax table for 2024 and know your tax bracket, the amount owed, and how to compute your tax.

Source: cybqrhonda.pages.dev

Source: cybqrhonda.pages.dev

2024 Tax Brackets Philippines Jana Rivkah, Learn how to navigate the complexities and save money. Philippines annual bonus tax calculator 2024, use icalculator™ ph to instantly calculate your salary increase in 2024 with the latest philippines tax tables.

Source: thelmawmilka.pages.dev

Source: thelmawmilka.pages.dev

Tax Bracket Philippines 2024 Brynne Maisey, Just enter your gross income and the tool quickly calculates your net pay after taxes and. It outlines how much tax individuals and corporations must pay depending on their.

Whether You’re An Individual Or A Freelancer,.

The bir income tax table is a helpful tool for filipino taxpayers to use when calculating their taxes due.

This Tool Is Designed For Simplicity And Ease Of Use, Focusing Solely On.

With our calculator, you can get an estimate of your income tax.

Posted in 2024